Table of Contents

Spodumene theoretically contains 8.03% Li2O and therefore the production of this mineral is greatly increasing because of the expanded use of lithium in the manufacture of high temperature insoluble lubricants, ceramics, pyrotechnics, non-ferrous welding fluxes, air purifying agents, and hydrogen isotopes.

Extracting Lithium from its Ore

The problems of spodumene mineral dressing depend on the amount of ore deposit, weathering and presence of associated gangue minerals. Weathered mineral surfaces must be thoroughly cleaned for selective flotation. Slimes interfere with selective flotation and also consume expensive reagents. Therefore, the slimes must be eliminated prior to conditioning and flotation. Concentrates should be about 6.00% Li2O.

The selective separation of gangue minerals requires acid-proof mining equipment, which is described more fully in Flowsheet Study on Feldspar.

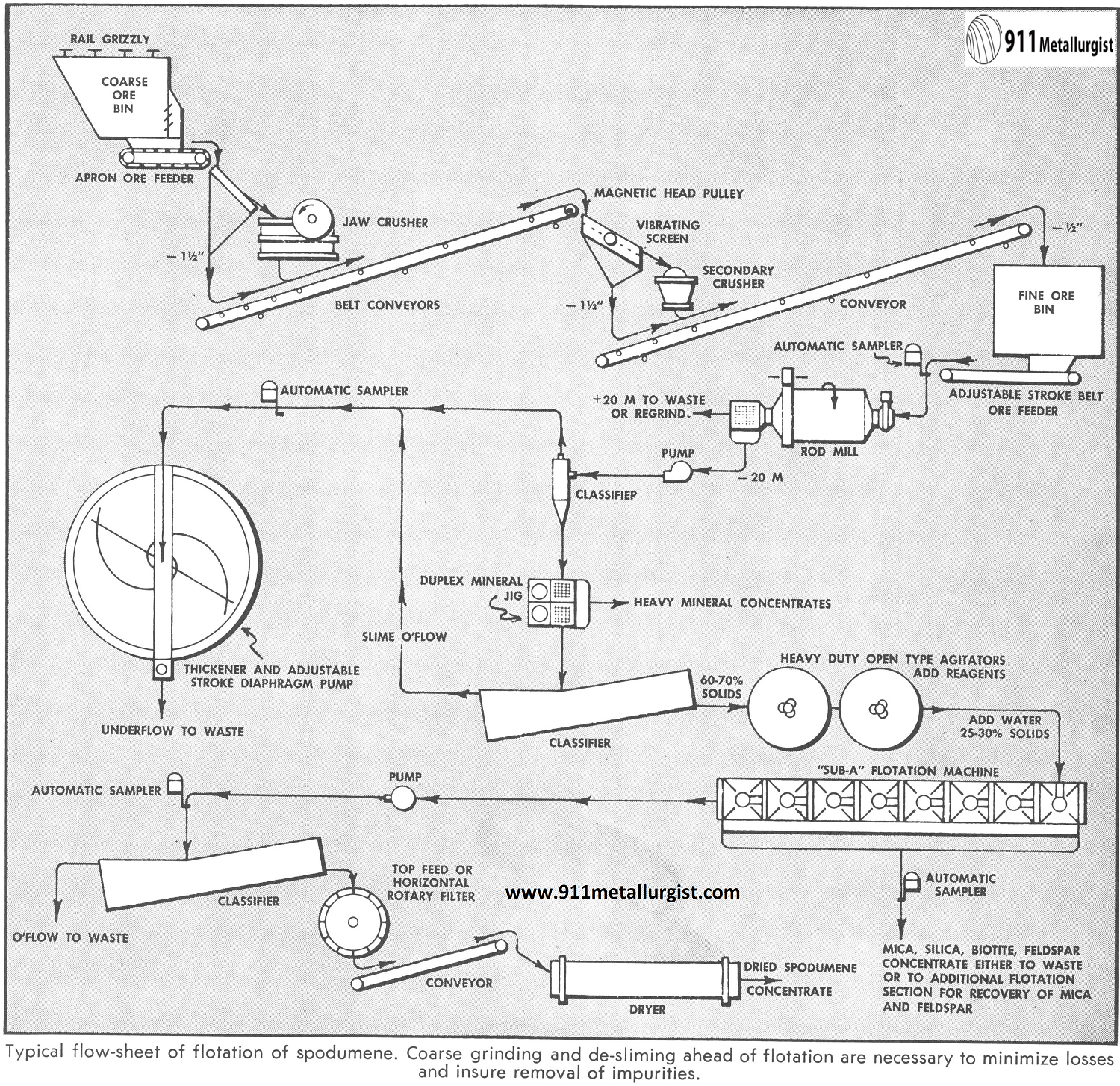

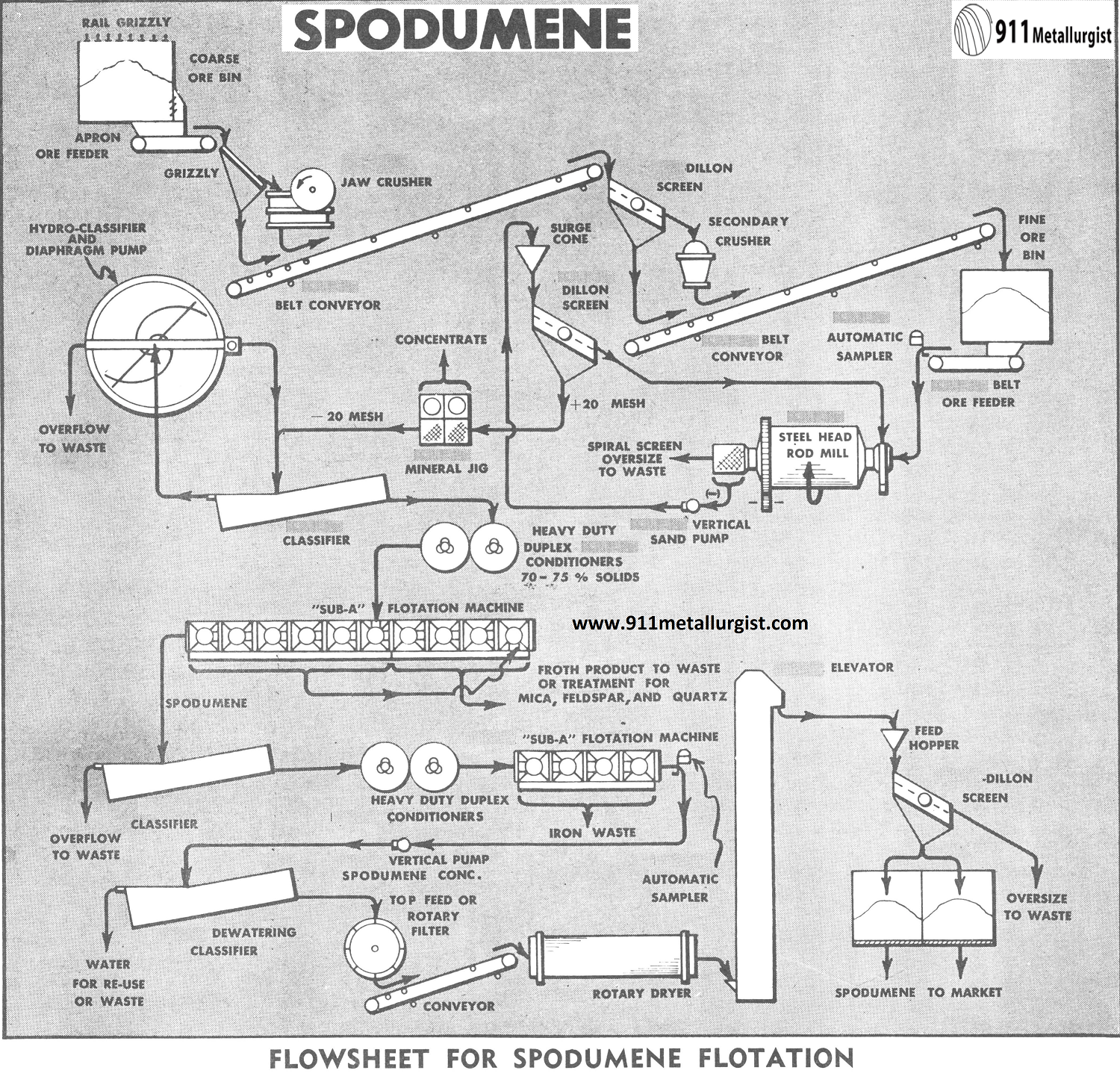

The Lithium Ore Flowsheet

Fatty acid or soap flotation of spodumene is one well established recovery method, but pulverized or ground particle surface conditions generally necessitate pre-flotation treatment. This involves high density agitation with cleaning agents such as sodium silicofluoride, trisodium phosphate, or sodium sulphide with sodium hydroxide. The pulp is then deslimed.

Agitation with anionic collectors, followed by flotation, will often result in satisfactory spodumene concentration when the spodumene is to be floated. Oleic acids and soaps work well in neutral and slightly alkaline pulps, while naphthenic acids, sulphonated castor oil, etc., work best in an acid pulp.

The flowsheet shown is based on recommendations which involve the froth removal of gangue minerals in an alkaline circuit with an amine collector. The spodumene is depressed with dextrine and removed as a high grade concentrate. Since this method is selective for the separation of mica, feldspar, and quartz, it solves the problem of marketing all possible products.

A Mineral Jig is included to recover a heavy mineral concentrate.

Crushing

Mine run ore is usually bulky to avoid fines and definitely requires a rail grizzly to limit the size of coarse ore fed to the jaw crusher. Two stage, open circuit crushing is satisfactory in the 200 ton per 8 hour production range. The resulting fine ore is smaller than ½” or ¾”.

A stationary grizzly, set at approximately 1½” opening, removes undersize from the primary jaw crusher feed. A Vibrating Screen removes the undersize from the secondary crusher feed. Removal of undersize reduces the amount of resulting fines and increases the capacity of the equipment.

Grinding and Classification

The Steel Head Rod Mill has proven extremely satisfactory for grinding such pegmatitic mineral as feldspar and spodumene. The grinding circuit should have a controlled feed rate which is accomplished with a Adjustable Stroke or variable-speed Belt Feeder. Sufficient fine ore-bin storage should be available for at least one day capacity, and preferably more storage should be available.

The pre-flotation treatment generally begins at the rod-mill. A cleaning agent such as sodium silicofluoride, trisodium phosphate, or sodium sulphide with sodium hydroxide is added with the fine crushed ore to the rod mill and grinding is accomplished with a dilute pulp (25-35% solids). A Spiral Screen on the rod mill discharge eliminates tramp oversize from the grinding circuit, which is closed with a Vertical Centrifugal Sand Pump and Vibrating Screen. The vibrating screen is equipped with stainless steel screen cloth for 20 to 30 mesh separation.

The vibrating screen undersize (— 20 mesh range) is then deslimed in a Hydroclassifier and dewatered in a Rake Classifier after the pulp has been processed in a Mineral Jig. The jig removes a heavy mineral concentrate such as tin and columbium.

Conditioning

High density conditioning in the 70-75% solids range is very important to prepare mineral surfaces and assure proper reagent coating. Therefore, heavy duty Agitators are used. The duplex Agitator gives high concentration of horsepower and eliminates short circuiting.

The deslimed and washed pulp at (70-75% solids) is conditioned for about 5 minutes with a .5 lb./ton to approximately 1 lb./ton amounts each of the reagents as follows: a pH regulator such as lime; dextrine; amine acetate such as Armac T; and an alcohol frother. The pH is kept in the 10-11.5 range due to the unstable tendency of the amine collector above pH 11.5.

Reagent preparation involves little difficulty, as the liquid and dry reagents can be easily fed to conditioner with Reagent Feeders. However, the viscous amine reagents in bulk form generally require heat and agitation to provide a satisfactory liquid feed.

Lithium Ore (Spodumene) Flotation

The conditioned pulp is diluted to approximately 20% solids for flotation in “Sub-A” Flotation Machines of standard steel construction. The cell to cell type machine with spitzkasten and froth paddles is used as well as the open-flow type. The open-flow machine has some advantage in coarse sand handling characteristics, and sand gates are placed very near to the bottom of the machine to improve passage of the 20 mesh sand fraction. Conical impellers and hood wearing plates of molded rubber construction give satisfactory service for this coarse, abrasive job. However, molded rubber receded disc impellers and diffuser type wearing plates also give satisfactory results when operated at speed higher than the conical disc impellers.

Roughing and Cleaning

The froth product from initial rougher flotation represents gangue contaminants and is cleaned in additional flotation cells with more reagents to increase recovery of spodumene. No attempt is made in the rougher circuit to remove iron minerals.

Final Cleaning

The combined rougher and cleaner tailing, which is the spodumene product with iron mineral contaminants, is then washed in a rake classifier and thickened for conditioning at 70-75% solids. Reagents for the removal of iron minerals include a combination such as hydrofluoric acid for a pH of 5, sodium resinate and a frother.

The conditioned pulp is then diluted to a 20-25% solids for flotation. Complete removal of iron minerals along with some remaining feldspar is accomplished in a froth product which is small and is discarded.

Although not indicated on the flowsheet, the final cleaner gangue froth, which contains feldspar and mica, can be processed in an acid circuit for the recovery of mica first. Then hydrofluoric acid amine flotation is used to separate feldspar from quartz.

Filtering-Drying

The spodumene concentrate is discharged at the tailing discharge of the flotation machine and is ready for final processing. The spodumene pulp contains approximately 20% solids and must be dewatered before filtration to reduce the volume of filtrate. Dewatering to 20% moisture is accomplished in a Rake Type Classifier with little or no loss of solids in the water overflow.

The classifier sands are filtered best on a top feed or horizontal filter. Due to the fast settling, granular nature of the spodumene, conventional drum and disc filters are unsuitable. Filtration reduces the moisture content to less than 10% and the filter discharge is ready for drying.

Direct fired Standard Rotary Dryers satisfactorily remove the balance of the moisture. A Vibrating Screen removes any tramp material that finds its way into the flotation circuit, and the spodumene is then ready for shipment to market or chemical processing for recovery of lithium salts.

Lithium Sector Report

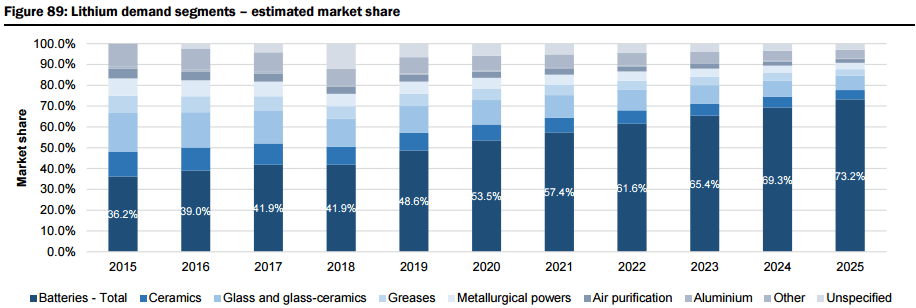

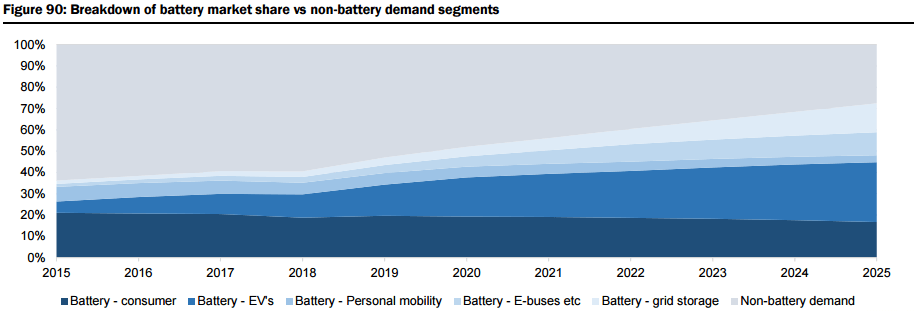

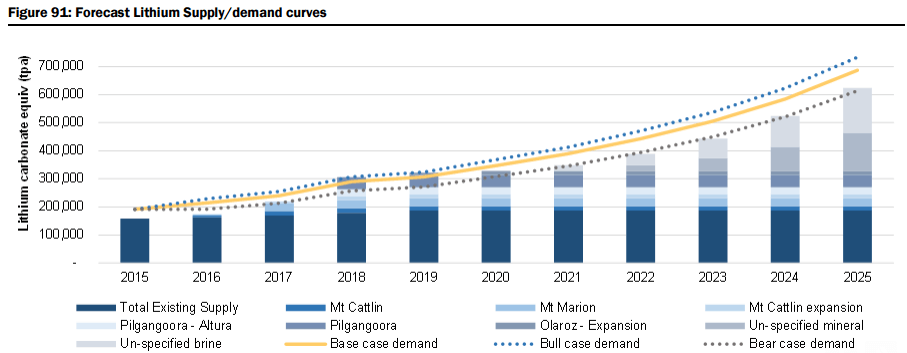

The report includes a very detailed demand analysis (i.e. Li-ion batteries with a look at cathode chemistry for lithium carbonate vs. lithium hydroxide, and the relative lithium content for various types of oxide cathodes, plus lithium-ion battery usage by different market segments including Passenger Electric Vehicles (EV), E-Buses, personal electric mobility (E-Bikes), grid storage, and consumer electronic products, as well as more traditional Industrial applications including ceramics and glass ceramics, greases & lubricants, metallurgical powders, air and purification). They forecast the lithium demand to grow by 81% from the current 192kt lithium carbonate equivalent (LCE) to 347kt LCE by 2020, and by 259% to 687kt LCE by 2025 (Figure 88), representing a CAGR of 14% across all demand sectors, driven by demand for Li-ion battery-based electric vehicles accounting for 38% of all lithium demand by 2025 (from ~6% in 2015), as well as significant demand from the grid storage sector, which they forecast will account for 13.6% of all demand by 2025 (Figure 89 & 90).

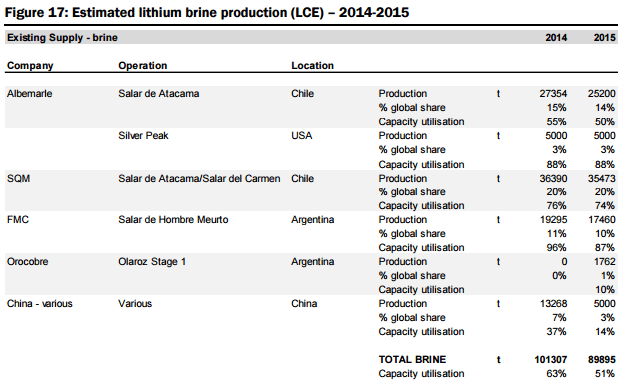

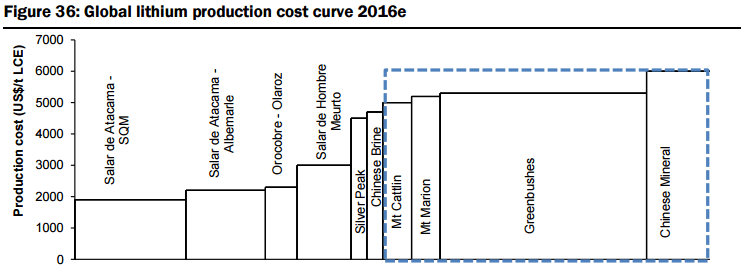

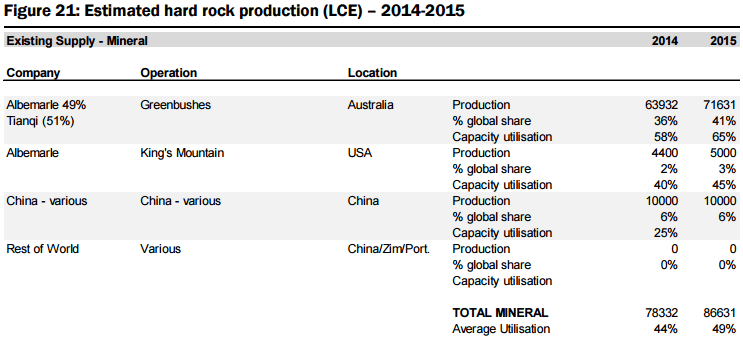

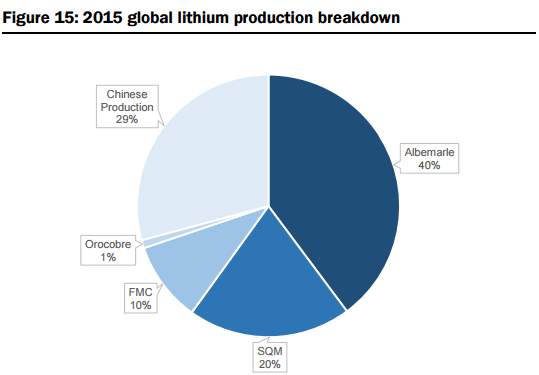

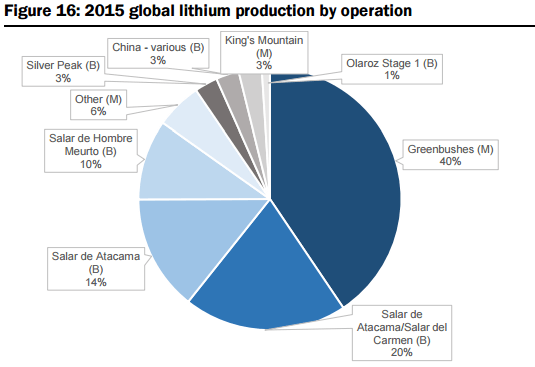

On the supply side, they estimate global supply at 176kt LCE in 2015, with production dominated by six operations owned by four major companies (representing 91% of total market share, including Albemarle (ALB-US, not covered), SQM (SQM-US, not covered), FMC Corp (FMC-US, not covered), and Sichuan Tianqi Lithium Industries (002466-CH, not covered) see Figures 15 and 16 below. The report includes a summary of the two primary mineral sources for Lithium production, their associated metallurgical recovery processes, and capex & operating cost profiles:

a) lithium brine deposits are formed through the leaching of volcanic rocks in basin depositional environments. Li is extracted from brines via a process involving the pumping of brine from the sediment basin, concentration via evaporation, and purification through solvent extraction, absorption, and ionic exchange, with the end product mainly in the form of refined Li2CO3

b) Hard rock spodumene deposits are comprised of lithium-bearing, aluminium silicate mineral which mostly occurs in lithium-rich pegmatites (granite-like igneous rock composed of quartz, feldspar and mica). Spodumene is usually recovered through conventional open pit mining methods and beneficiated via gravity techniques where the ore is concentrated from 1-2% Li2O to a grade of ~6% Li2O.

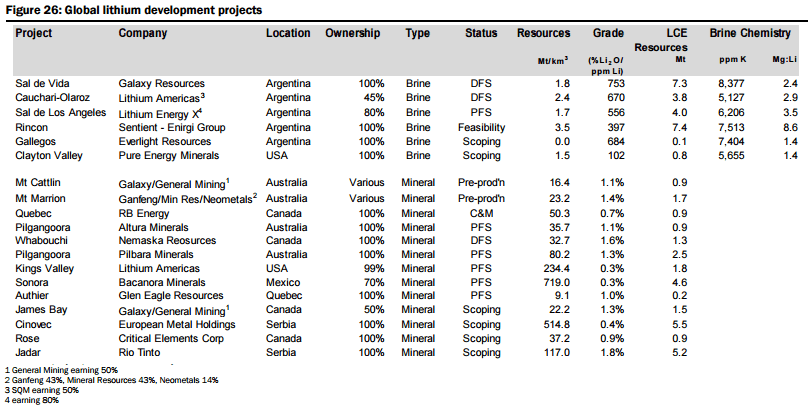

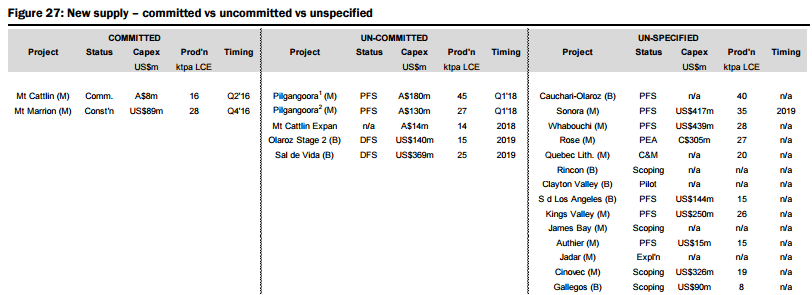

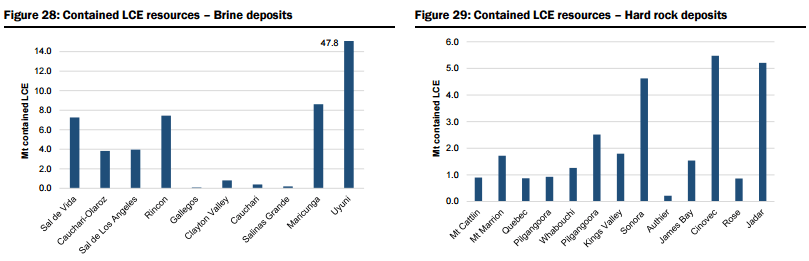

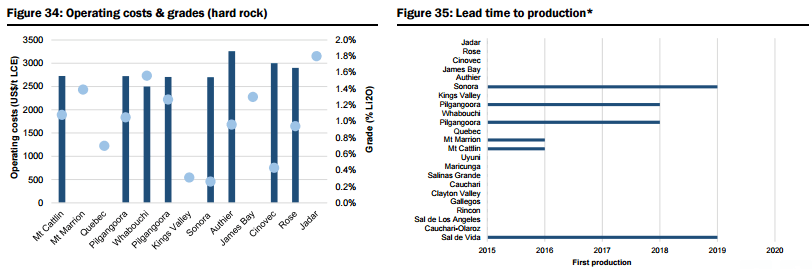

In determining an expected supply side response, they have analysed over 60 lithium projects around the globe, with 19 advanced stage projects offering potential for a total of ~400kt LCE in new supply within the next 5-6 years (see Figure 26 below), with two to commence production before the end of 2016 (Galaxy/General Mining’s Mt Cattlin spodumene operation currently being commissioned and the Mt Marrion spodumene project owned by a consortium consisting of Jiangxi Ganfeng Lithium, Mineral Resources, and Neometals). They have categorised the modelled new supply sources into various categories (Figure 27):

- Committed (the two projects mentioned above),

- Uncommitted (advanced stage with completion of definitive feasibility studies expected in the next 6 months, relatively modest capital hurdles, and potential to enter production within 3 years, including Pilbara’s Pilgangoora, Altura’s Pilgangoora, Orocobre’s Olaroz, and Galaxy’s Sal de Vida), and

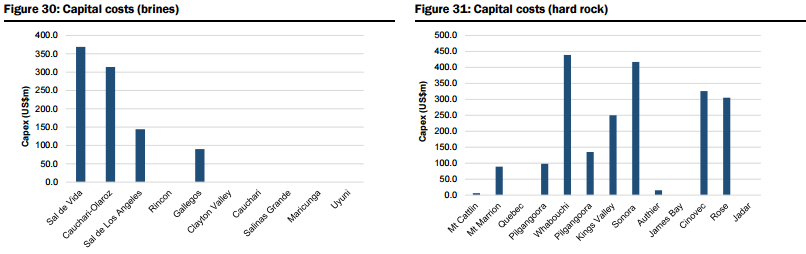

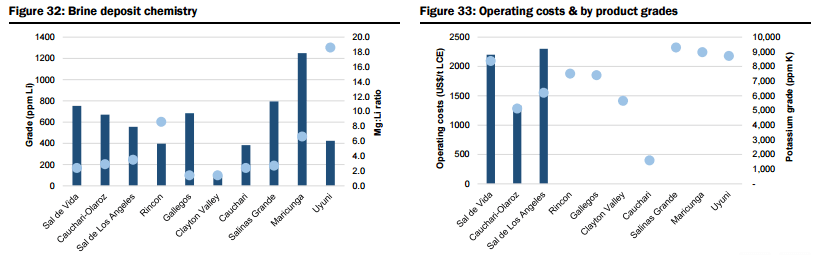

- Unspecified (potential new sources of supply, both lithium brine and hard rock, that could achieve production within 5-6 years but which are mostly at earlier stages of development, are proposing to utilise unproven extraction/processing techniques, have relatively high capital costs or uncertain lead times to production, including Lithium America’s Cauchari-Olaroz, Baconora’s Sonora, Nemaska’s Whabouchi, and Critical Element’s Rose). In Figures 28 to 35 below, they compare the key attributes to assess the potential of projects in the Unspecified category and the order/time frame on which they may be brought into production (i.e. for Brines: chemistry, including grades and impurity levels such as magnesium and boron have an impact capital and operating costs, capex, and lead time to production; and for Hard rock: grade, which impacts operating costs via achieving required concentrate specifications and acceptance among converters, and capital costs).

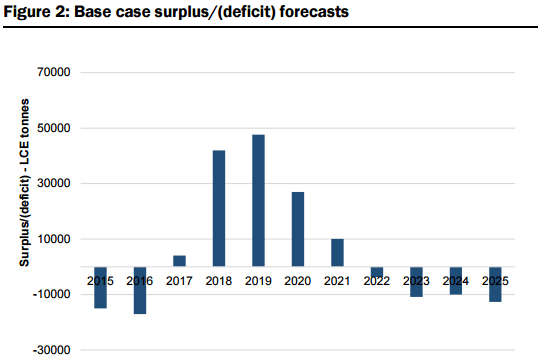

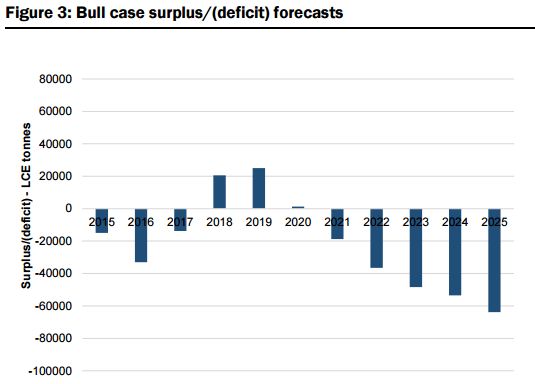

Market Surplus/Deficit Forecasts & Pricing: Based on their modelled market supply assumptions (uncommitted and unspecified new supply comes on as modelled) and base case demand projections (estimated CAGR of 14% to 2025), they forecast market oversupply of 13% in 2018 (38kt LCE) and 14% in 2019 (43kt LCE) see Figure 2 & 3 below. That said, they also forecast the market to swing back to balance/deficit by 2021, and by 2025, estimate that an additional 510kt (above 2015 supply estimates of 176kt LCE) of LCE production is required to meet the modelled demand estimates. Figure 91 also illustrates their “bull” case demand projections, which assumes an 8% annual increase in demand over their base case projections. Under this scenario, which assumes no change to the supply assumptions, they estimate a peak market surplus of 25kt LCE in 2019, and a market deficit in 7 out of 10 years to 2025. However, with their research indicating there are at least 18 advanced projects globally representing a potential ~400kt of new supply that could potentially be brought on stream within 5-6 years, they would expect in reality that any deficits may be much less severe. Under our modelled “bear” case scenario (assumes 8% less demand versus our base case), they estimate that the market would remain in constant oversupply over our forecast period, with peak oversupply of 29% in 2019, and a surplus of 9% in 2025.

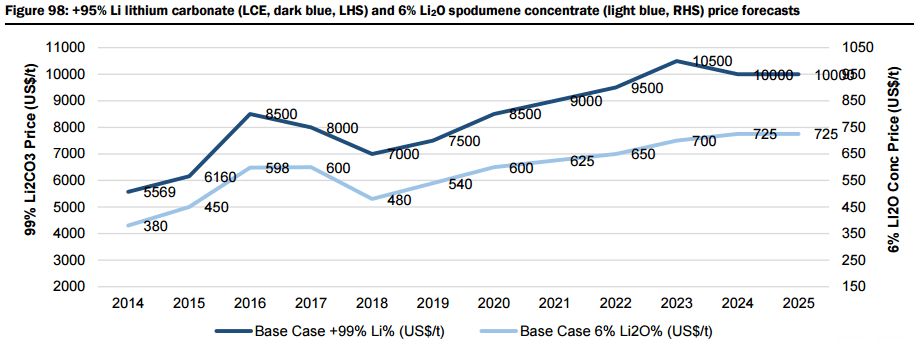

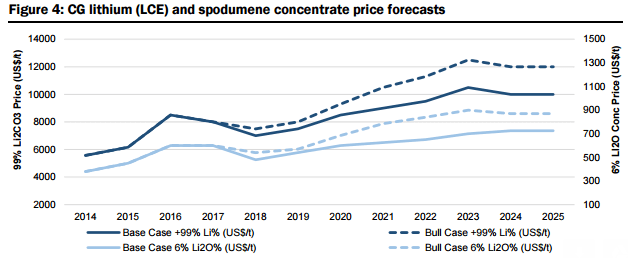

Therefore, based on their supply/demand modelling, they forecast lithium carbonate prices to rise from US$6,000/t in 2015 to US$10,500/t in 2025, with spodumene concentrate prices expected to experience a similar increase from US$450/t in 2015 to US$725/t in 2025. Under their “bull” case demand scenario, they forecast lithium carbonate prices to rise to US$12,000/t and spodumene concentrate to US$870/t by 2025.

The updated price deck has the following impact on their current coverage universe.

CHARTS FROM CANARCORD GENUINE ESTIMATES

Spodumene Extraction

Spodumene Market Specifications

Li2O, minimum………………………………………………………………………….6.0 per cent

Fe2O3, maximum……………………………………………………………………….0.5 per cent

Production Problems

Pegmatite ores containing spodumene always contain several other minerals such as mica, feldspar, quartz, and iron and other silicates that have a tendency to concentrate with the spodumene. Weathering and surface oxidation of the rock also give rise to alteration products that interfere with flotation.

Reagent Combination

The reagent combination, to be most effective, should be worked out for each deposit by laboratory tests and pilot-plant treatment. The following combination, for a North Carolina deposit, involves two steps of flotation.

Gangue minerals such as mica, feldspar, and quartz are first floated after grinding the ore and de-sliming by treatment with a cationic collector in alkaline circuit, and with starch or dextrine, to depress spodumene and iron minerals. The iron minerals are then removed by flotation in acid circuit with sodium resinate as collector and hydrofluoric acid as an inhibitor for the spodumene, which is thus concentrated in the tailing product.

Source: This article is a reproduction of an excerpt of “In the Public Domain” documents held in 911Metallurgy Corp’s private library.