How Explorers develop an exploration strategy, how they develop an exploration model and design an exploration program and select the optimal exploration tools to carry out that program. As usual of the talk will end with a series of learning points from this talk.

How Explorers develop an exploration strategy, how they develop an exploration model and design an exploration program and select the optimal exploration tools to carry out that program. As usual of the talk will end with a series of learning points from this talk.

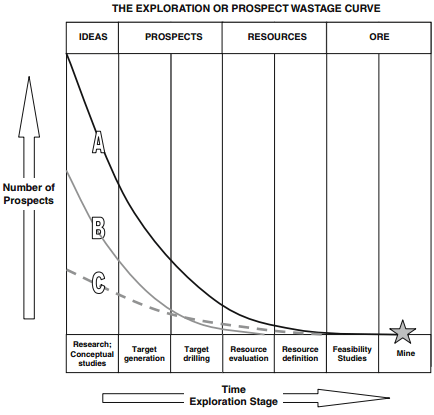

There are two fundamental truths about the exploration industry; the first is that most exploration programs are doomed to failure. It’s been estimated that only 1 in 5000 or even 10,000 of all prospects will eventually be shown to halt deposits that can support a viable mining operation. Therefore the odds are that the vast majority of exploration programs will end up with nothing to show for the dollars they’ve spent. The second fundamental truth is that most Explorationists has more ideas than they have funding to test those ideas. These two truths mean that simply playing the odds and drilling hundreds of targets is a short cut to financial ruin. If they are able to be successful, companies need to develop their explorations strategy with a huge amount of thought and research. The old adage of failing to prepare is preparing to fail holds particularly true to the exploration industry.

Before getting into designing and exploration strategy lets touch on how the exploration industry has changed over the last 10 years and how the balance between the Majors and Mid-tier and Junior companies have shifted. Ten years ago the majors carried out most of their own exploration focusing on the search for very big deposits that they could mine themselves while keeping an eye on the juniors just in case one of them stumbled over something big enough to be of interest. A few majors did in fact buy out juniors that have made huge discoveries such as Diamond fields voiesy’s Bay or the Hemlo discovery but most prefer to do their own exploration but over the years the majors in an attempt to reduce risk decided that they would rather pay more for a genuine discovery via Junior than to carry out their own and often fruitless exploration. The majors virtually ceased regional exploration and were focused entirely on the exploring for extensions and satellites of deposits that they were already mining and activity known as Brown fields exploration or Minex. In the last few years the mid-tier started following suit. Some of the major and mid-tier companies bought advanced projects from juniors only to find that they didn’t live up to expectations. Such as Kinross’s purchase of the underworlds white gold discovery in the Yukon or Red Backs Tasiast in Mauritania where they found that the politics of the country where deposit is located changed for the worst as in the case of Fruta del norte deposit in Ecuador which Kinross bought for almost $1 billion and then walked away from when the Ecuadorian government enacted outrageous mining legislation.

At the moment most of the majors and mid-tier minors are so risk averse that none of them seem to be interested in doing their own exploration or doing any acquisitions. Their boards and management seem paralyzed by fear of failure an attitude which will cost them dearly in the long run. Mining is a high risk enterprise and as the British SAS motto says “who dares wins” or “you snooze you lose”.

Generally much of the exploration industry is now supported by the efforts of the junior exploration companies with the Majors depending on the Juniors discoveries but there is a problem with an industry model that relies on juniors. Most of the easy targets have been found and many of the juniors really don’t have the technical skills to explore for the more difficult targets. In addition whereas the majors used to have a recently assured and relatively stable funding to be able to take on long time high cost and high-risk exploration most juniors have neither of these things living a hand to mouth existence.

So the result is that there is a lot of money wasted on easy but worth less targets that really have no chance of proofing economic for a major minor. There are currently very few companies that have both the steady funding and internal skill set and vision to take on the job of exploring for the next generation of big mines. Ivanhoe Mining is one of the few companies operating in this ever-growing void between the majors and juniors.

Okay so now let’s return to how an exploration strategy is designed. There are initially three very simple questions that need to be answered before the strategy can be decided: What commodity and deposit type are we going to look for? Where are we going to focus our efforts and how are we going to explore? The answer to the first question is often driven by market cycles which commodities have perceived are anticipated supply shortfall. When the uranium price rises every man and his dog is setting up a Junior Explorer to look for it, whether or not they know anything about uranium. On the other hand when Fukushima was destroyed by the tsunami and the public’s knee-jerk reaction caused governments to close down nuclear reactors and canceled others under construction no new uranium companies were listed on the stock markets. A serious exploration strategy has to be much more farsighted than this as it may take 6 to 10 years for discovery to be made.

Deposit to be delineated, feasibility studies to be carried out, permits received, construction completed before the production can actually begin. History is lit with discoveries that didn’t make it until the following cycle because the discovery came at a time when commodity prices were declining. Once it is decided what commodity to focus on we have to decide on what ore deposit type to look for and where they occur as we have seed in earlier ore deposit 101 talks most commodities can be found in more than one class of ore deposit. Deciding which one or ones to search for should depend partly on the skill sets and the experience of the explorers. Too often I see companies with good technical people switching their efforts to a deposit type that they have no experience in simply because it is the flavor of the month. Some discoveries are serendipitous with luck playing a huge parts but the majority of discoveries come out of hard work and a deep understanding of the mineralization controls of a particularly class of ore deposits and the geology of an area that they occur in. Selection of where to focus efforts is the primary decision the strategy is built on focus; where the geology and the tectonics are right for the type of ore deposits that you are seeking and where your team has experience both technically and commercially.

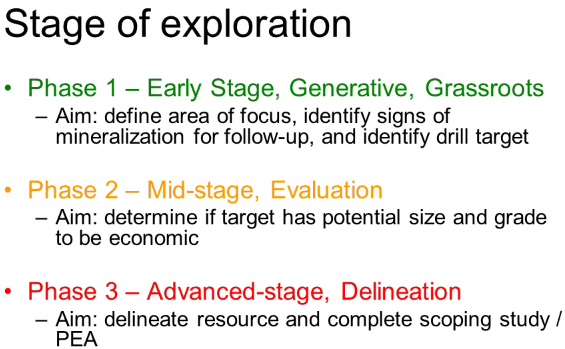

The answer to the final question about how we explore for the commodity of interested is answered by building a genetic model and an exploration model. Now what’s the difference between these two a genetic model builds up an understanding of how the deposits form and what are the critical controls on the mineralization. So we need to ask questions such as; what are the preferred host rocks? Are they structurally controlled or stratigraphically controlled? Is the fluid temperature a critical issue or not? What sorts of hydrothermal alteration are they associated with if any? What are the associated minerals? Is there a preferred time period when the deposits are formed? What sort of dimensions are deposits likely to have? And a hundred similar considerations. The aim of the genetic model is to end up with a mental picture of the deposit you’re looking for, how it forms and what its physical characteristics are; only once this step has been done and we know the physical characteristics can we select the right exploration talk’s to connect the characteristic features of the type of deposit. Genetic models are often criticized as being too academic and of being of no value to really pragmatic explorationists. This is partially correct, genetic model as an end to themselves are of only very limited value but they are a vital means to an end and that end is the exploration model.

The aim of the exploration model is to match certain of the physical characteristics to find in the genetic model to available exploration tools that can detect those physical characteristics. So for example if you determine that you were going to be looking for copper porphyry, your genetic model will tell you among other things that the mineralization occurs as discrete disseminated sulfide particles in a stock work of fine cord stringers. There is therefore no point in using Electro Magnetics or EM to explore as this will only detect massive sulfides. Instead you would use Induced Polarization – IP which is very good at detecting disseminated sulfides in the same way you would know that porphyry mineralization is usually associated with potassic alteration and that is characterized by the presence of potassium phosphors, secondary biotite and magnetite. A magnetic survey ought to be able to detect the magnetite and hence indirectly the best host for any associated copper mineralization. I’ll talk more about the exploration model shortly.

There are a number of points that need to be borne in mind during the process of designing and exploration strategy, let’s discuss these. Some explorationists who used to practice their profession in the big mining houses that have deep pockets go about exploration with; any information is good information approach. They say let’s collect a full spectrum of data and then we can decide which data sets are of most value but you will remember that one of the fundamental truths that I mentioned earlier, is that most explorationist have many more ideas than they have funding to test those ideas. Most mid-tiers and certainly all juniors are limited by their budgets. They have to be much more surgical in selecting which data sets they spend their budgets collecting. They need to ask themselves; what are the key questions that I need to answer? And is my proposal for the program focusing on those questions? If the answer is no but just that it would be nice to have the data then that work should be scrapped or at least put on ice. We need to clearly define decision points of the program before starting.

When I ask exploration managers; what would make you walk away from this project? And I get an answer; I can’t answer that until I’ve seen what the data tells me, warning bells go off in my head. This program has not been thought through and its budgets and timeline are likely to slip. Likewise I want to see a clear measurable decision points for example a statement; I want to show the clear evidence of a potentially economic mineralized system doesn’t cut it. An answer like this provides too many loop holes to allow a dog of a project to continue to be funded. I’m looking for something along the lines of; if I don’t intersect at least 10 m at one ground per ton gold in 3 of m 8 holes I will need to walk away from the property or completely rethink this program. It’s quite possible that a drill program will blow one hypothesis out of the water but will all show that another hypothesis is worth testing. Hence the validity of the “or completely rethink this program clause” but this has to be stringently applied and this brings me on to the last point in this slide. Exploration programs do have to be kept flexible, new data’s coming in the whole time and the program should be refined as that data is absorbed. It’s astonishing how often I see big drill programs some lasting many months being doggedly carried on as originally designed even though the early holes show that the underlined hypothesis is clearly flawed. Exploration budgets should always be conditioned on success and should be regularly reviewed and re-prioritized. Finally although perseverance in the face of adversity is important, beware of the company that has evidently fallen in love with their project and is blind to the growing evidence that it is a dead horse and one that they should have stopped flogging long ago.

So those are some of the pointers on how exploration strategies are constructed. We have now decided; what commodity we are going to look for and where we are going to focus our efforts geographical? Now we need to use that exploration model that we constructed to decide; how are we going to explore for our chosen target? Which exploration tools are we going to choose to take along with us? And much of the rest of this talk will focus on this question. The difficulties of mineral exploration are sometimes compared to a blind man trying to describe an elephant, when all he has to go by is the small portion of the elephant that he can touch and feel. At best only a small portion of an ore deposit is visible at surface and increasingly the ore bodies aren’t outcropped at all. So the job of the geologists is to take the clues that can be collected by the various exploration methods and come up with a mental picture of what the deposit may look like and then to test that hypothesis using the most time and cost efficient processes you can. In many ways exploration is also like playing golf. When you play golf you choose your club to suit the task an the terrain, a driver to get into the right area, a chipper to get into the sand into the green, a sandwich to get out of the traps and a putter to sink the ball.

In the same way during exploration the selection of the correct exploration tool depends on the stage of the exploration, the features of the deposit type from the exploration model and the exploration environment.

So let’s start with the stage of the exploration project. There are several ways of classifying exploration programs i.e. a program that has not reached Feasibility study but most divide the process into three:

Phase 1 exploration also known as early-stage, generative our grassroots; at this stage the objective is to define the geographic area of focus, identify signs of mineralization for follow-up and identify drill targets. Programs at this stage will require regional targeting tools and I will go into these in some detail shortly.

Phase 2 exploration also known as mid-stage or evaluation, at this stage the objective is to determine if the target has the potential size and grade to be economic. Programs at this stage will require focusing tools including recognizance drilling.

Phase 3 exploration is also known as advanced stage or delineation. At this stage the objective is to delineate the results of the targets and to complete a scoping study or Preliminary Economic Assessment PEA. This requires detailed drilling, resource estimation and preliminary engineering and metallurgy, the selection of possible mining method and preliminary financial estimates.

Having established what stage the exploration program will be the next factor to be considered in selecting exploration tools to be used are the features of the targeted exploration deposit type. This is where we return to the exploration model that we constructed, the model has defined the likely characteristics of the ore body we are looking for and we need to select tools that can detect those characteristics. Some characteristics can be detected directly such as magnetics e.g. the magnetite and in deposits or radioactivity in the case of uranium deposits or electro-magnetivity in the case of massive sulfides and these are relatively straightforward but other

deposits do not have any characteristics that can be directly detected by geo-physical methods.

This is where the exploration geologists has to think laterally and look for exploration techniques that can detect features that may be just associated with the mineralization. Examples of these includes magnetics to detect the process of faults that may have acted as channel waves for hydrothermal fluids or gravity to detect a particularly heavy host rock or lighter than average alteration. In other words the exploration model tells you which features to look for and so which techniques to use.

The third main factor to consider in selecting exploration tools is the nature of the environment that you will be working in. Here too the geologists’ need to ask himself a number of questions for example; is the weathering likely to be deep or shallow? This is significant because the geophysical and geochemical characteristics of the original primary ore change as the mineralization is oxidized. Is there surficial cover? Surficial cover might mask radiation and obscure or disperse geochemical anomalies. Is the terrain mountainous or flat for example a big factor for large size gravity survey is impractical in a mountainous terrain and rough typography will also limit airborne surveys in fixed wing aircraft and it may be necessary to switch to a helicopter borne method. How thick is the vegetation cover? Thick tree canopies can mask infrared spectrometer surveys and Thick Mountain tropical forest can make soil sampling very difficult or impossible. What are the climatic conditions? High rainfall in the tropics will result in a very different soil profile from one in the cold high Arctic and the geochemical techniques need to be adapted accordingly. For example in the latter case stream sediment samples might need to be replaced by till sampling each of these issues and many others will contribute to the selection of the most cost-effective exploration tool for the job.

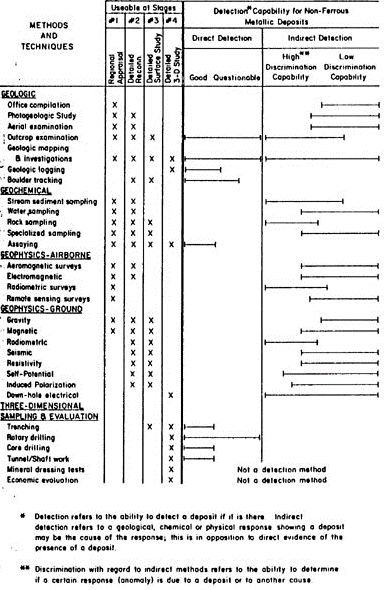

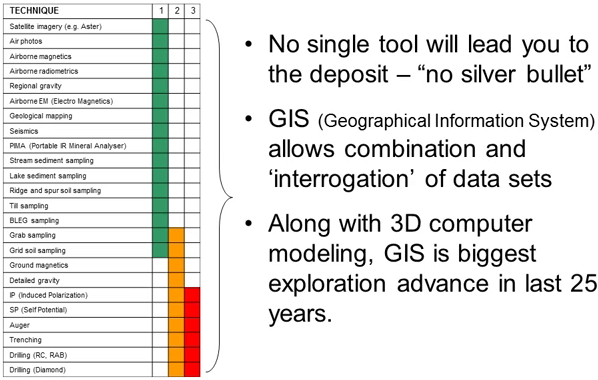

Now this table summarizes the most commonly used exploration tools that are available to exploration teams. They also show us which tools are employed in phase 1 in green, phase 2 in orange and phase 3 in red exploration programs. We’ll go through this list discussing each of the tools starting with the first of the phase 1 tools; the wider seeing technique, satellite imagery and air photo.

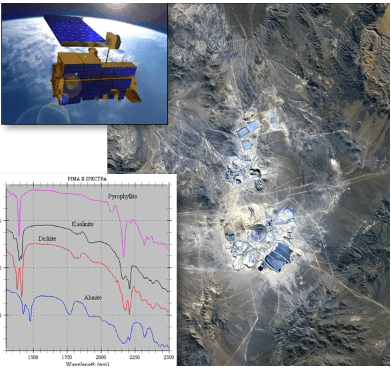

Serial air photo interpretation used to be the foundation of regional exploration. It’s now under-utilized but it is still very valuable with trained specialists and I don’t think it is used enough nowadays. In the last 20 to 30 years satellite imagery as edged out air photos particularly a technology call Advanced Space Born Thermal Emission and Reflection Radiometry. Fortunately this mouthful can be abbreviated to ASTER.

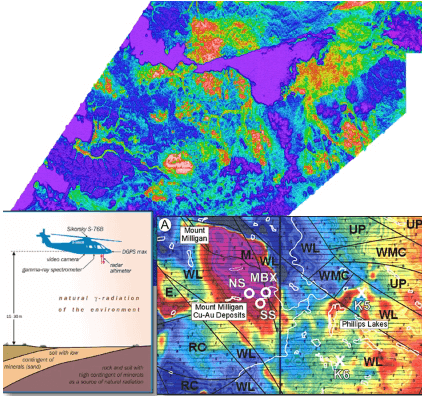

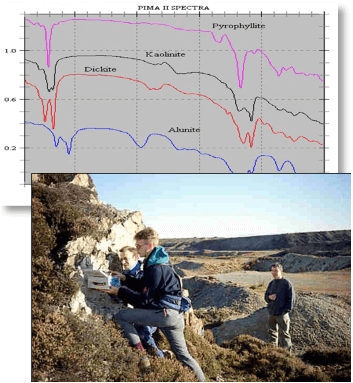

ASTER data is collected from a satellite with 700 km sun synchronous orbit. Different minerals absorb different wave lengths of infrared light and reflect others. A sensor in the satellite detects the frequencies of the reflected light and uses this information to identify the minerals present. The method has a relatively coarse resolution with individual pixels being 15 m². Airborne infrared scanners are mounted on much lower flying aircraft can improve this resolution considerably but the data costs much more to acquire. Infrared imagery is very useful for picking up widespread hydrothermal alterations and it can differentiate between various clays even though clays are usually too fine-grained to identify by eye even with a hand lens. Mineralization is associated with large alterations zones such as porphyries, high sulfidation epithermal, VMS deposits and Carlin deposits can often be detected with these technologies. Remember this example of the Escondido deposit lecture on porphyries where the pink color is reflecting the presence of potassium feldspars indicative of potentially or hosting potassic alteration.

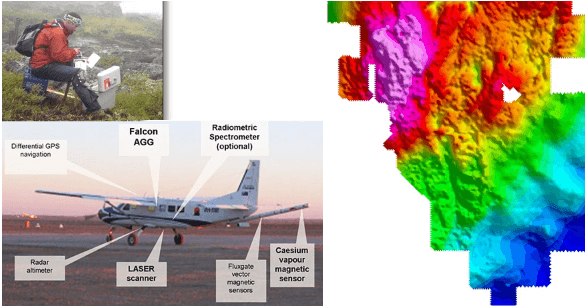

Airborne magnetic surveys provide a very quick and relatively cheap method of collecting data when measured on per square kilometer basis. Recently there’s been increasing use of ultra-light aircraft and pilot-less drones with miniaturized equipment as instrument platforms. These surveys can detect magnetic rocks through cover. The method is great for exploration for buried magnetic ore bodies and host rocks and here you can see for example a feature less part of the Southern Botswana completely blanketed under a thick cover of wind deposited Calamari Sands, you can see nothing but when the magnetic data is super impose the hidden kimberlites’ intrusions become apparent. Magnetics is also useful for identifying potassic alteration in porphyries and to finding faults in the glacial cover for example in many Canadian green circuit belts.

Radiometric surveys are often flown at the same time as magnetics but radiometric surveys need a full-sized aircraft, the scintillometer are heavy. The survey measures radiation from the decay of uranium and potassium and thorium. The response is only the form the very surface with the penetration of just a few millimeters unlike magnetics or gravity which can penetrate many kilometers of overlying cover rocks. Radiometric surveys are useful for uranium deposits of most types but also porphyry deposits to identify the potassic alteration and different phases of the intrusion as in this example of Mount Milligan and high sulfidation epithermal deposits.

Regional gravity; some rocks are more dense than others the gravity survey can detect the subtle differences. Regional ground gravity surveys are relatively slow, expensive to collect and so they usually have sparse data and poor resolution but newer airborne techniques using gradiometers are changing all this. Here is an image of Twin Creeks deposit in Northern Nevada, the Southeast half of the image is on the younger cover, less dense, poorly consolidated gravel cover. This is why it is slightly blurred and blue which represents lower gravity. Gravity is good for Carlin deposit exploration looking for up faltered blocks of heavy carbonate host under this gravel cover and also for looking for calcite destruction. It’s also used in exploration for VMS deposits and nickel sulfides both of which have large quantities of heavy sulfide minerals.

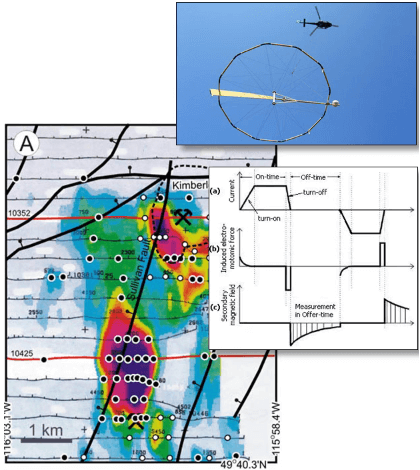

Airborne Electromagnetics or EM; there are several techniques of airborne EM including input, geotin, megatin, veotin and ziten but they are all variations on a theme. They basically generate and electromagnetic signal and then measured its decay plotting this variation over the area. Surveys can be done from the ground but they are usually flown in a helicopter or fixed wing. They are rapid and relatively low-cost although more expensive than magnetics and less direct. The transvector coil can be under ground or on the aircraft; the receiver is usually towed in a bird. The system detects conductive rocks and so it is used for exploring for VMS, SEDEX; example on the side is the Sullivan deposit in BC, massive copper nickel sulfides and iron ore. Of course false anomalies are also common especially coming from graphite.

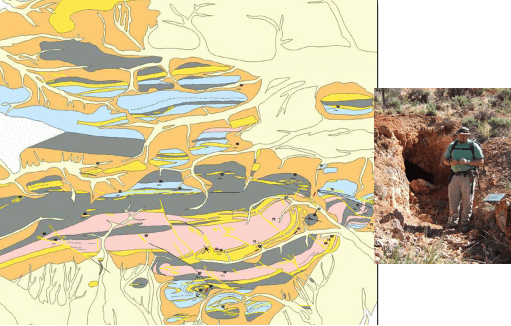

Geological mapping; all the previous exploration techniques are remote methods that can be carried out without even putting a foot on the ground. Geological mapping is a direct technique and it is a critical part of most exploration programs. Boots on the ground the aim is to identify potential host rocks, structures and out cropping mineralization. Geological mapping is the foundation on which other data sets are super imposed.

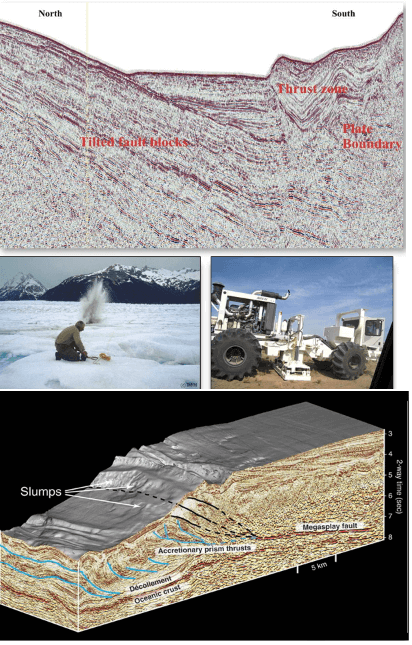

Seismic surveys detect variations in seismic velocities in the earth’s crust and so only work with in-homogenous stratigraphy. The principle is to produce shock waves at the surface and then measure the echo as the waves are reflected or re-fractured or rock boundaries at depth. The initial shock waves are created by explosives or vibrations using big trucks that repeatedly drop weights our simply break large pads in contact with the ground. The echoes are detected with rays set out on the surface. The data can either be 2D a single plane our cross section like this or 3D like this model.

Seismic are useful for detecting structure and stratigraphy but the technique works poorly if these are steeply dipping. Seismic was originally developed for oil exploration but now it is used more extensively for hard rock targets than before. The main drawback of the technique is its expense and the delay in processing the data. The main users are still for oil exploration where it’s the primary tool, unconformity related uranium, Witwatersrand and Carlin deposits, Greenstone share hosted gold and VMS deposit.

Pima which is an abbreviation for Portable Infrared Mineral Analyzer. The equipment analyzes the wave length of reflected lights in other words it’s like a handheld ASTER. Its main use is in mapping hydrothermal alteration as it is capable of differentiating between clay minerals that are to fine-grained to separate by eye or even using a hand lens. It’s valuable for ground follow-up or satellite imagery and alteration quantification in drill cores and chips. An example of a really successful Pima based exploration program was Placer Dome’s mapping program. Six geologists covered 160 km x 60 km area in just two months collecting representative hand specimens and then analyzing them with the Pima overnight in the base camp. This allowed real-time follow-up and detailed sampling over anomalous areas. The team identified and mapped five hydrothermal systems and discovered three zones of epidermal mineralization in a single very short summer field season.

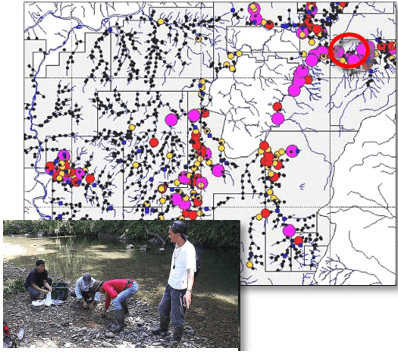

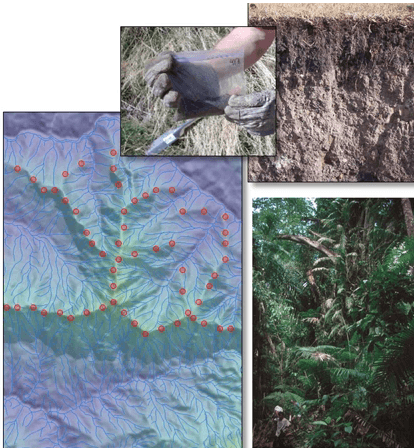

Stream sediment sampling this is a quick, cheap, regional geo-chemical technique that allows you to follow up within the areas of the highest potential. It’s obviously of limited use in arid areas or in areas of muted topography where there is little or no sediment transport. It’s used for a variety of deposit types including base and precious metals, tin and chrome. The data in this image is from exploration targets in Ecuador. The ringed areas where the Fruta del norte epithermal gold deposit was eventually discovered. The other anomalies have not yet been properly explored to my knowledge.

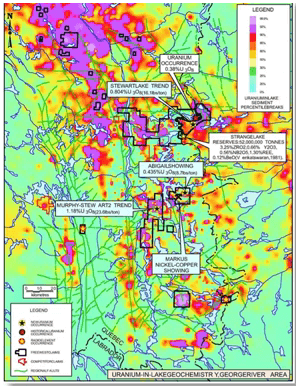

Lake sediment sampling: This is a similar technique to stream sediment sampling but it’s used where there is a high density of lakes and flat topography means that the streams flow very slowly and they don’t transport significant sediments. So this method can be done or used to be done by hand from boats or harboring through the ice in winter but now it’s generally done by helicopter dropping a gravity core sampler. The method has been used for base metals, gold, uranium and diamonds.

Ridge and spur soil sampling: There are various techniques of soil sampling these include collecting by hand or using an auger. Most take a sample from the seas end just above bedrock and assay of a 50 g sample generally using 32 element ICP plus or minus fire assay, Ridge and spur sampling is used in mountainous terrains where movement is difficult for example in Tropical Rainforest. Samples are taken from the ridges as these are not affected by soil creep and they are easy to traverse than the steep flanks of mountains.

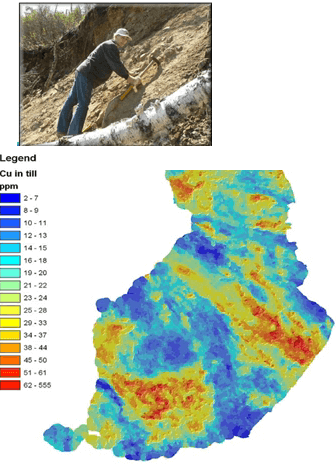

Till sampling this involves collecting material that was dropped by glaciers and ice sheets. It is similar in concept to soil sampling but there is no in-situ soil, just transported glacial debris or till. With this technique you are looking for a trail of eroded mineralized material that has been dragged and then dropped by moving ice sheets. The example shows copper nickel is in exploration in Finland. In this case the sample spacing is only one sample for every 4 km² so it is a very efficient method of covering area quickly.

BLEGS or Bulk Leach Extractable Gold: It’s a version of stream sediment or soil something but it involves taking much bigger samples of fine grain material say 2 to 5 kg. The sample is then leached with cyanide rather than using a traditional extraction and assay method. The technique is aimed exclusively at gold which requires only a very wide sample spacing and so it is very useful as a first pass exploration tool because of the dilution factors much lower values are regarded as anomalous and significant than they would be in conventional soil sampling. This particular photo was taken in Mali notice the sieve being used to select only the fine material for assay.

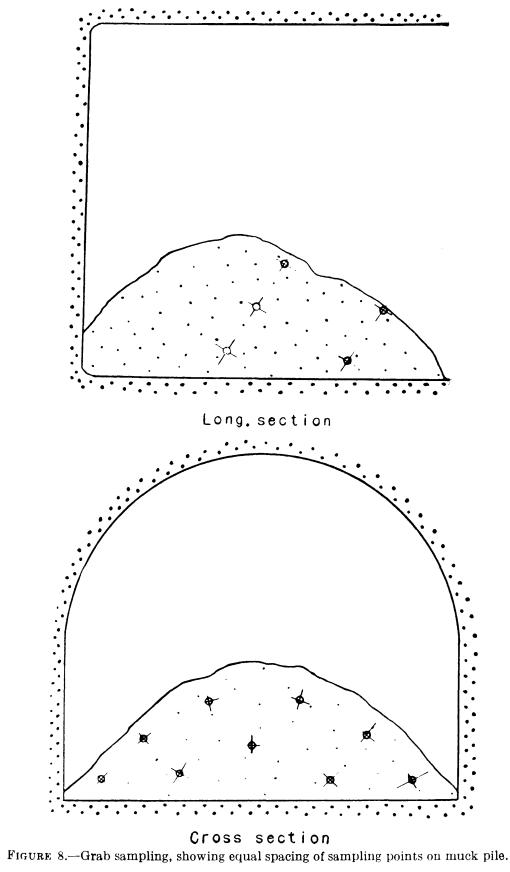

Grab sampling also known as rock chip sampling this is use both in very early recognizance sampling to see if there is any indication of anomalous metal values and also in more detailed mapping. In our golfing analogy this would be the five iron used to get you close to the green. The actual assay value is not significant we just need to see what it is relative to the average background value. The sample usually consists of a fist sized chunk preferably of an out crop but float samples are also of value. Samples are usually collected while mapping in most environments.

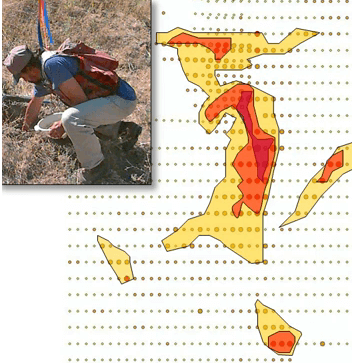

Grid soil sampling this technique is used in both phase 1 and phase 2 as the name inclines it consists of a systematic soil sampling along lines that are 25 m to 1 km apart along each traverse individual samples are generally taken 10 to 100 m apart. Contour intervals are calculated using just statistics. Obviously the technique requires soil so it’s good in Tropical and Subtropical areas where good soil profiles are developed. Soil sample is an excellent way to define the limits of shallow mineralization. There are a couple of caveats, beware of soil that creep and dispersed anomalies on slopes ensure your sampling in-situ soil and not transported soil and ensure that the samples are taken of consistent material. The sample is usually sifted to collect only the fines 50 to 100 g is needed for a reliable assay. The method is used both for base and precious metals and also

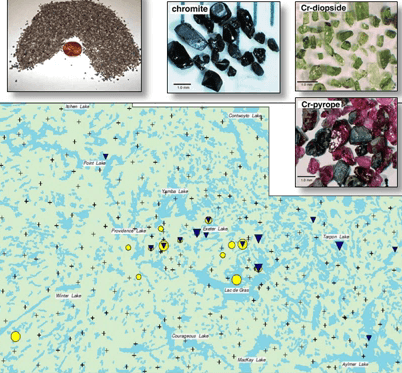

White based soil or till sampling is used to detect kimberlites but host diamonds. You take a large soil sample, sift it to concentrate the sand sized portion and this is then separated by gravity to collect the heavy minerals looking for kimberlite indicator minerals or kims which include chromite, chromium dioxide and chrome rich minerals. If these are present then you increase the sample density and use geophysics if the kimberlite doesn’t outcrop. The above map covers an area of 200 km x 160 km and you can see that the samples were taken 10 to 20 km apart and that this was a sufficient density that draws explorers into that swarm of kimberlite pipes.

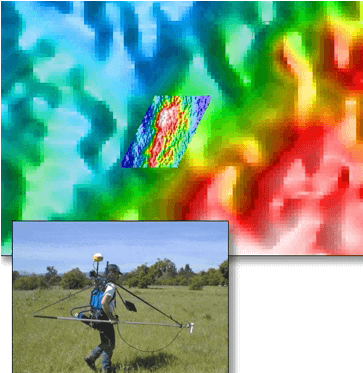

Ground magnetics is carried out to follow-up broad air borne magnetic surveys and to provide a higher resolution over selected areas. An integral GPS automatically plots data as the operator walks along. The technique is obviously of use in looking for highly magnetic ore bodies e.g. ones that contain magnetite or portite or reduction in magnetics due to alteration for example sulfidation of magnetite. It is also used for defining structure of mineralization itself isn’t magnetic. It can be used for VMS, SEDEX, sulfide nickel porphyries iron ore, Archean gold veins, chromite and platinum group metals. In fact magnetics is one of the most useful and most widely used exploration techniques.

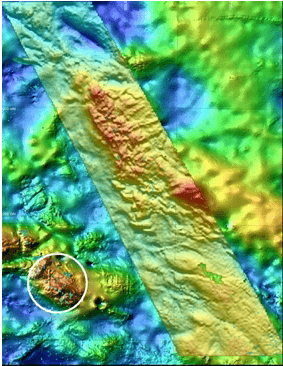

Detailed gravities are used the same way as detailed ground magnetics. You fill in detail over selected areas of interest. The example shown is of known (Inaudible 40:06) Punt-hill property in South Australia just south of the Olympic Dam. You can see the difference in resolution between the area in the Northeast and the area in the South West of the image. (Inaudible 40:19) drilled the anomaly in the white circle hitting IOCG style mineralization although it proved too deep to be economic so far. Gravity is of use with VMS, sedex, carlin, IOCG, iron ore and kimberlite deposits.

Now for techniques generally used in both phase 2 and phase 3 explorations.

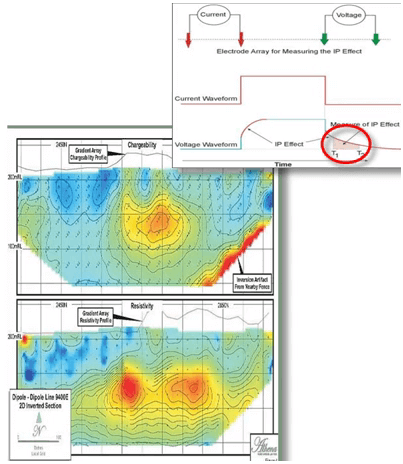

IP or Induce Polarization. IP is an electrical geophysical method where intermittent current is fed into the earth and the response is measured through other electrodes. The data includes both resistivity and chargeability. Resistivity measures the ease or difficulty with which the earth conducts electricity for example solidification is highly resistive. Chargeability is a measure of the decay of the signal after the current is switched off. Chargeability detects disseminated sulfides but not massive sulfides, it’s used on epithermal, and Archean share hosted gold porphyries and Carlin deposits. It’s not of use with massive sulfides for example in the VMS or SEDEX or nickel sulfides. It can reliably only penetrate to a depth of about 250 m or some of the newer equipment claiming to be able to see down to 500 m are deeper.

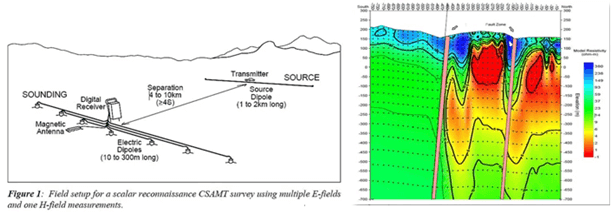

CSAMT, this is an advanced geophysical technique. CSAMT stands for Controlled Source Audio Frequency Magnetotellurics it uses the same principle as IP in other words it measures the conductivity of rocks but it uses much bigger transmitter luke and so does far greater depth penetration down to three or four more kilometers, CSAMT played a part in the discovery of reservoir minerals deposit in Serbia.

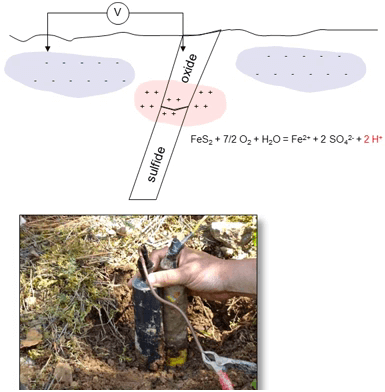

Self-Potential or SP this is a very cheap and simple geophysical technique it relies on oxidizing sulfides which produce a potential current between them and the surrounding ground it requires only a very simple galvanometer no current is put into the ground unlike with IP. SP is effective if conditions for oxidation are right in other words shallow groundwater, warm climates and high sulfide content in the ore body but it actually isn’t used much as IP is much more effective. It will detect massive sulfides better than disseminated sulfides.

Auger is a method that are used for sampling the third dimension. Auger is really just deep soil sampling and seldom extends to more than 10 m depth. It can be carried out with a vehicle mounted machine or a small hand held machine although I have showed it as being used in both phase 2 and three projects its most commonly used in phase 2 ones.

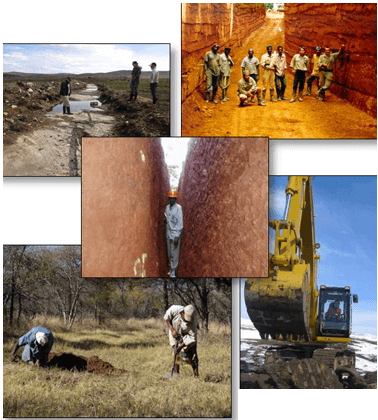

Trenching covers a multitude things ranging from scraping thin moss or soil cover or out crop to 5 m trenches in deep tropical soils. Trenches can be dug by hand or trencher by excavator or bulldozer and the aim is simply to expose bed rock for mapping and sampling. Trenching provides a link between the indirect geochemical or geophysical methods and direct soil drilled sampling. It’s cheap, it’s quick and it provides valuable information on rock type, structure, mineralogy and grade. It’s used on a wide variety of deposit types. Environmental regulations usually require that the trenches are filled in and re-vegetated after mapping and sampling are complete.

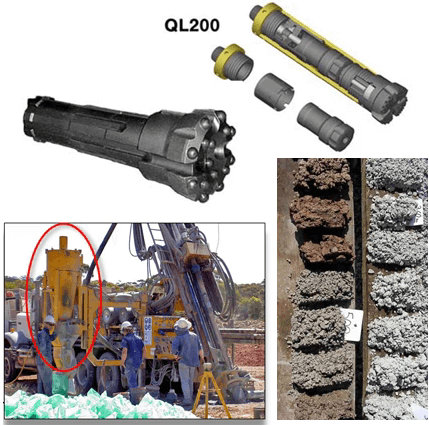

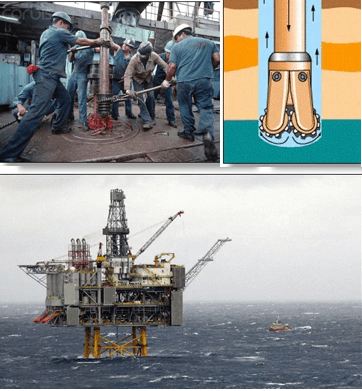

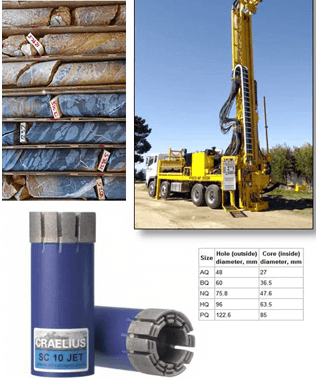

Drilling is an indispensable method for exploring the third dimension. The drill rig is sometimes referred to as the truth machine. There are a variety of different drilled techniques. Reverse circulation is one of the most common. An RC bit is solid is solid with tungsten buttons it’s attached to a hammer and double walled drill rods, a compressor blows air down the outer tube and the drill cuttings are blown up the inner tube. Cuttings are collected from the cyclone the big yellow cone at the bottom left of the picture. So what are the advantages of RC; its fast, it’s relatively cheap and has a reasonably depth capability of maybe down to 500 m depending on how much ground orchard there is and the disadvantages well firstly it produces small rock chips only which yield far less information than drill core. secondly there is a tendency to smear grade down the whole and thirdly RC does not perform very well in wet conditions in other words below the water table. RC is good for large disseminated deposits which smearing of grade isn’t quite so critical.

A drill method common in Australia is RAB or Rotary Air Blast. It’ very similar to RC but it doesn’t have the double tubes and the rods so the sample blows up the outside. The advantages well it’s very quick and cheap and the disadvantage is it produces chips only like the RC it also has limited depth capability usually less than 150 m and the same poor performance in wet conditions as RC but most importantly it is prone to contamination from this size of the hole. RAB is often used for ore delineation in open pit mining operations.

Oil and gas still rigs are some of the simplest in theory. Collection of sample from the hole is not critical except for identification of stratigraphic position and is only drilled to test for the presence of hydrocarbons and then to provide a well to extract the oil and gas so it just needs a bit in a way of pumping the fluid or mud down the hole to flush out those cuttings. Although simple in theory oil rigs are enormously complex pieces of equipment partly because of the depths that they drill to and the marine environment that they often operate in. Drill holes are large diameter usually 5 to 36 inch in diameter and it can attain a depth of up to 25,000 feet. They are usually fitted with steerable bits which allow deviations of the hole to turn the hole in a certain direction or to flatten it to horizontal. Once production well is drilled the rig is replaced with a much simpler production platform.

Diamond drilling or core drilling this is the ideal method for most exploration but is generally about three times the cost of RC per meter. The phrase diamond drilling refers to the drill bit which is studded with industrial diamonds in a metal matrix it produces a core of solid rock which provides much more geological information than RC chips. The diamond drill can reach between 304,000 m depending on the rig type. In a wild line rig the core is collected in a core barrel and hold up the center of the drill after every 5 to 10 m without having to instruct the entire length of drill rods. This speeds it up enormously. Diamond drill core is usually split or sew length ways half goes for assay and half is kept as record. Diamond drilling is essential for drilling narrow vein deposits as there is no downhole grade smearing as there is in RC. It’s also valuable for structurally controlled deposit such as Archean sheer zone hosted gold and VMS deposits.

Exploration is a process of logical hypothesis building and testing and exploration tools have to be chosen carefully to allow the most efficient testing of the hypothesis. No single tool will lead you to the deposit there is no single silver bullet. Groups of tools are used in combination to rule out or prove possibilities moving steadily from the big picture hypothesis to the more detailed data collection to a final discovery. Because of the variety of data sets that need to be compared and combined GIS technology or geographical information systems which allow for the combination and the interrogation of varied data sets is essential. GIS is the glue that holds the parts of an exploration program together. To my mind along with the development of 3D computer modeling, GIS can be considered to be one of the biggest single advances in the exploration industry in the last 25 years.

Firstly majors are yielding the exploration function to juniors this is good and bad; good because the juniors are lighter on their feet and maybe less wasteful in their expenditure, bad because only a small minority of juniors are both truly competent and sufficiently well-funded to do anything more than shallow chicken scratching projects. Very few groups are now doing long-term exploration programs for big targets. Exploration consists of a series of systematic steps focusing in from the broad scale to detailed testing. In this process the exploration geo has to define both a genetic and the exploration model. He has a wide range of tools to choose from. The selection of the appropriate tool depends upon several factors the stage of exploration, the geological characteristics of the ore body and the environment of the project. Exploration needs a rigorous target selection nobody can simply play it as a numbers game the odds of success with this approach are far too long. The program as a design needs to identify the hypothesis and test required to improve or him or disprove that hypothesis and finally clear decision points are needed to avoid target creep and wasting of funds on dead horses and finally strict budget control.